Tarsadia Capital, LLC together with its affiliates, associates and funds it manages (“Tarsadia”), today released an open letter to shareholders of Extended Stay America, Inc. (NASDAQ: STAY) (“STAY” or the “Company”) encouraging them to continue to oppose the Company’s proposed sale to Blackstone Real Estate Partners and Starwood Capital Group (the “Sale”). Tarsadia also noted that independent proxy advisor Glass, Lewis & Co. reiterated its recommendation that shareholders vote against the transaction despite the $1 per share increase in consideration offered by Blackstone and Starwood.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210607005576/en/

Figure 1 (Graphic: Business Wire)

The full text of the letter follows and is also available at www.ABetterFutureforSTAY.com/s/STAY-Shareholder-Letter-June-7-FINAL.pdf.

June 7, 2021

Dear Fellow Extended Stay Shareholders,

As you know, Blackstone Real Estate Partners (“Blackstone”) and Starwood Capital Group (“Starwood”) have faced strong shareholder opposition to their purchase of Extended Stay America, Inc. (NASDAQ: STAY) (“STAY” or the “Company”) for a grossly inadequate price, at the wrong time in the lodging cycle and after a fatally flawed process. As a result, they are attempting to Band-Aid over the myriad issues with this transaction, as well as proxy advisory firm opposition, with a mere $1 per share bump in price.

This changes nothing.

By nearly every measure, the new proposed price – $20.50 per share – is grossly inadequate. It is also wholly untested in the merger market because the Company failed to contact even a single other potential buyer, allowed Blackstone and Starwood to partner together instead of competing against each other, and failed to secure a go-shop provision. Given the circumstances surrounding this sweetheart deal with Blackstone, STAY’s former financial sponsor with whom certain members of the Extended Stay America Board of Directors (the “Board”) have a continuing relationship, a small price bump offers little solace to shareholders.

We intend to vote AGAINST this transaction and encourage you to do the same. To support this transaction would set a poor precedent: private equity buyers would then know that even when they strike inadequate deals with friendly (and at-risk) boards after a shoddy process, a mere dollar increase will cure all ills.

As leading proxy advisory firm Glass, Lewis & Co. (“Glass Lewis”) wrote last Friday:1

“[W]e do not believe the revised offer price of $20.50 per share is sufficient to warrant supporting the proposed transaction at this time. In our view, the price increase of $1.00 per share, or approximately 5.1%, does not go far enough to address outstanding concerns with the deal process, timing and valuation.”

The path to a fair transaction is not a minimal incremental bump that aims to appease shareholders for the failures of the Board. It is instead a new and robust process, overseen by a refreshed and independent Board, that aims to maximize the value of STAY for its shareholders.

Further, STAY shareholders do not need a transaction at this time. Tarsadia continues to believe STAY is well positioned to benefit from a multi-year recovery in the lodging industry fueled by COVID vaccine distribution, pent-up travel demand and fiscal stimulus. With a reconstituted Board consisting of independent directors, STAY will be well-positioned to pursue a number of attractive standalone opportunities to create value, potentially including: retaining a commercial real estate broker to pursue accretive asset sales, jump starting the franchise program, optimizing the capital structure and then evaluating its corporate structure or strategic alternatives.

The executive team has recently turned oddly dire in its forecasts for the prospects of a standalone STAY, predicting a declining stock price, oddly quoting a pessimistic sell-side analyst, and suddenly discovering the need for hundreds of millions in new capex spending. This reversal in outlook coincided with the approval by the Board of an extremely rich and entirely new change-in-control benefit that will bring the CEO’s payday to more than $16 million next week, if, and only if, the transaction with Blackstone and Starwood is completed.

We are skeptical of these new predictions of impending doom for a standalone STAY. We continue to believe there is meaningful upside to $20.50 and very little downside. Our independent nominees for the Board are committed to running a full and fair strategic alternatives process, and helping to improve the standalone strategy and prospects for STAY. We have confidence in the future value of the stock.

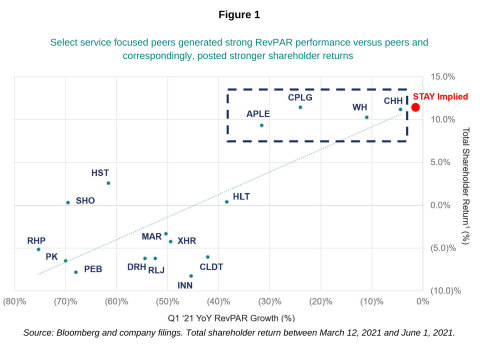

Indeed, by all objective measures STAY has recently been performing very well and the stock would be up – by nearly $2 per share, we believe – if no deal had been announced at all. The stock prices of select service peers have increased since the STAY transaction was announced, and the recent performance of lodging stocks have been strongly correlated to Q1 RevPAR. STAY’s -1.4% Q1 2021 year-over-year RevPAR growth was the single best performance among the public lodging peers and our industry research suggests that STAY RevPAR is near pre-COVID levels. If the RevPAR-to-stock-price correlation held for STAY, its stock would be trading 11% higher than its pre-deal price, or at approximately $18.80 per share in the absence of a deal. See Figure 1.

With downside likely limited to $18.80 and substantial upside from a full and fair strategic alternatives process (and alternatively from improved standalone prospects under the oversight of a new Board), we have confidence in our conviction that shareholders should not support the current offer.

As Glass Lewis noted:

“[W]e continue to believe that the Company’s stand-alone prospects are sufficiently appealing to warrant rejecting the proposed [revised] transaction in the absence of a more attractive take-out valuation.”

We believe shareholders must reject this deal because it does not provide fair value and because it remains the result of a deeply flawed process that was not designed to elicit the highest offer. Shareholders who do not reject this deal run the risk that private equity sponsors and boards will design similarly flawed and self-serving processes in the future.

We are disappointed the Company delayed its meeting and call upon the Board to hold an up-or-down vote on June 11, without further delays. If the Sale is voted down, then the Company should immediately schedule its annual meeting and open the nomination window, to allow you to determine the future direction of STAY by selecting directors who are committed to the best interests of all shareholders.

Sincerely,

Tarsadia Capital

Tarsadia Urges STAY Shareholders to Vote AGAINST the Sale on the GOLD Card

For more information about why it is the wrong time and wrong price to sell STAY, please visit: www.ABetterFutureForStay.com.

About Tarsadia Capital

Tarsadia Capital, LLC is the New York-based investment management company of a family office. Tarsadia Capital has a flexible and long-duration investment mandate that focuses on equities and commodities globally. Our investment process employs deep fundamental research on secular inflections to identify and build conviction around asymmetric risk/reward opportunities that will play out over multi-year time horizons.

Disclaimer

Tarsadia Capital, LLC (“Tarsadia”), Ravi Bellur, Michael Ching, Vikram Patel, Ross H. Bierkan, Stephen P. Joyce and Michael A. Leven (collectively, the “Participants”) have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying form of proxy as well as a supplement to the definitive proxy statement to be used in connection with the solicitation of proxies from the shareholders of the Company for the Special Meeting. All shareholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying GOLD proxy card will be furnished to some or all of the Company’s shareholders and will be, along with other relevant documents, available at no charge on Tarsadia’s campaign website at: www.ABetterFutureForStay.com and the SEC website at http://www.sec.gov/.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained in the definitive proxy statement filed by certain of the Participants with the SEC on May 7, 2021 and the supplement to the definitive proxy statement filed by the Participants with the SEC on May 25, 2021. Each of these documents are available free of charge on the SEC website.

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this letter and the material contained herein are for general information only, and are not intended to provide investment advice. All statements contained in this letter that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements.

The projected results and statements contained in this letter and the material contained herein that are not historical facts are based on current expectations, speak only as of the date of this letter and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this material in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results.

All figures are unaudited estimates and subject to revision without notice. Tarsadia Capital disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results. Tarsadia Capital has neither sought nor obtained the consent from any third party to use any statements or information contained herein that have been obtained or derived from statements made or published by such third parties. Except as otherwise expressly stated herein, any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein.

____________________

1 Permission to quote from the Glass Lewis report was neither sought nor obtained. Emphasis added.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210607005576/en/

Contacts:

Sloane & Company

Dan Zacchei / Joe Germani

dzacchei@sloanepr.com / jgermani@sloanepr.com