( click to enlarge )

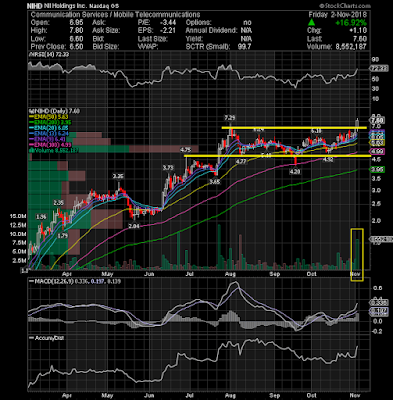

( click to enlarge )NII Holdings Inc (NASDAQ: NIHD) jumped $1.10, or 16.92%, to $7.6 on Friday, breaking out above its upper line of the sideways trend and a mid-term horizontal resistance zone on volume, sending a new buy signal. The measured price target of this breakout is at 9-9.20 range. Daily technical indicators are in bullish zones with all exponential moving averages rising. A continuation of the rally is likely.

( click to enlarge )

( click to enlarge )Evofem Biosciences Inc (NASDAQ: EVFM) Do you remember this symbol? We made a lot of money in the summer, when the stock rose from $2.30 to $4.96 in just few trading sessions. Since then the share price has been consolidating that move within a large bull flag pattern, which was broken in the final hour on Friday. Although technical analysis doesn't predict the future of a stock, studying previous price history and patterns can often help to determine what a stock may do in the future. In the case of EVFM this bull flag pattern is probably the most bullish chart pattern you can trade, because it occurs when a stock is in a strong uptrend. Daily technical indicators are also predicting a new strong move higher, with the RSI indicator rising while the MACD is cutting above its signal line. Over $4 it could make another explosive move upwards, so keep your eyes on it and watch it trade. My system gave a new buy alert and i entered long on Friday.

( click to enlarge )

( click to enlarge )Hope you all enjoyed a great bounce on Emerge Energy Services LP (NYSE: EMES) last week. I mentioned on blog as a potential bounce play, and BANG !!!! "We could see a 30-50% possible bounce up to $3.25 - $3.5 a share" A huge congratulations to all those who profited from last week idea. The stock rallied for over 50% potential gains on Friday session. I took profits but i will keep EMES on my watchlist for a possible re-entry. The next key resistance is located at 3.89 (declining EMA50).

( click to enlarge )

( click to enlarge )Altimmune Inc (NASDAQ: ALT) is another serious potential big runner next week. The stock has been witnessing increasing buying pressure for several consecutive trading sessions, with the accumulation line rising. I believe that the bullish accumulation witnessed over the last weeks is a prelude to what traders could see very soon. Daily technical indicators are looking bullish. MACD is rising above its signal line in negative zone. ALT's chart suggest that increased buy side activity could push share prices to much higher levels.

( click to enlarge )

( click to enlarge )Adamis Pharmaceuticals Corp (NASDAQ: ADMP) is recovering from its recent bottom with MACD Hist showing a positive divergence. It looks like the stock wants to breakout of this falling wedge pattern, but has not been able to gain the needed momentum. You should keep this stock on your screen radar next week.

( click to enlarge )

( click to enlarge )Acacia Communications, Inc. (NASDAQ: ACIA) Broke out yesterday on heavy volume and looks ready to test the highs.

( click to enlarge )

( click to enlarge )CorMedix Inc. (NYSEAMERICAN: CRMD) bounced strongly again from its long-term trend line on volume, which suggest a continuation of the current uptrend. As long as this trend line holds and the $1 level is intact we could see a bullish trend intact.

( click to enlarge )

( click to enlarge )Vaxart Inc (NASDAQ: VXRT) I still think this stock looks set to break higher. With flu season coming up, it could go to $4-$4.85 on a sharp rally. Chart looks very interesting here.

( click to enlarge )

( click to enlarge )AcelRx Pharmaceuticals Inc (NASDAQ: ACRX) broke out yesterday but didn't hold the strong gains above the breakout zone and closed at 4.80. Watching action closely up here. We need a close above 5.05 to see further gains. Buyable on a pullback to 4.25 imho

( click to enlarge )

( click to enlarge )Affimed NV (NASDAQ: AFMD) broke the falling wedge pattern last week. The volume confirmed the breakout as it was greater than average. Setting up for higher prices. Technically, dips should be bought. Next key resistance level lies at 4.64

I decided to share you all followers again my basic trading rules that should be taken always in consideration for trading in order to become a successful trader in the stock market.

1 - The trend is your friend, so never go against the trend. 2 - Keep your losses small. Golden rule: Cut losses short. Let profits run. 3 - Use stops. The stop loss should be placed few cents below the supports and not at the same level. 4 - Learn the basics of fundamentals, charts and technical indicators. 5 - The good trader is one who makes consistent gains, so don’t be a greedy trader, appreciate the small and the big gains. 6 - Do not fear the market. Be always confident in your trade decisions. 7 - Never buy what you do not want, because you think it is cheap. 8 - Always be conscious that the loss may arise and you should be prepared for that to happen. Open mind. 9 - For large positions, you must to have total control of the market never losing sight 10 - Volume is a leading indicator, so play the breakouts using the volume as support of your decision. 11 - Chart breaks without volume could be a trap and the probabilities of succeeding are low 12 - Do not be hasty to buy or sell a stock, every day there are new opportunities to make money. Be patient is the key of success of any trader. 13 - Only believe fundamentals as long as the technical signals follow. 14 - Trading very speculative stocks is a frequent mistake. 15 - Do not trade positions too large relative to your available capital. 16 - Do not invest all your money in one company. Your portfolio must be diversified. 17 - The Greed to pick tops or bottoms is a usual error. Wait for the perfect and confirmed signal. 18 - Do not make trading decisions based on a story you saw in the morning paper. The market many times has already discounted the information. 19 - Review your missteps to improve your skills

As i always say, with patience and discipline, you can take much more from the stock market than you ever gave. Trading stocks is not easy for beginners or professionals, it is really very hard and requires lot of attention and knowledge. If stock trading was easy, everyone would be doing it. You can be successful at the stock market, with patience, discipline and a good trade set-up. The key objective is to make money and not lose it.

Just a last note. Many thanks for helping AC Investor Blog surpass the 70000 Followers mark on Stocktwits! I'm going to try to get 35000 followers on Twitter before the year ends, maybe you guys can help me to achieve my goal. It's great to see that the number of followers are increasing day by day, which hopefully means that some people enjoy my daily stock tips. BIG THANK YOU !!

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC