( click to enlarge )

( click to enlarge )Viking Therapeutics Inc (NASDAQ: VKTX) jumped 99 cents, or 7.44% yesterday, breaking key resistance at 13.76 as well as the upper line of descending channel. Friday's action suggests we could see continuation of the trend in the next couple of days toward the next resistance level around the 15.5 area.

( click to enlarge )

( click to enlarge )Micron Technology, Inc. (NASDAQ: MU) Friday's hammer candle suggests a possible short-term bounce imho to $40's. Positive divergences showing up on indicators also confirm that we'll see some upside movement very soon. Obviously the trend is clearly down right now, but finding the right spot to get in before the bounce can be a lucrative move. I entered again before the close. Lets see what next week will bring us.

( click to enlarge )

( click to enlarge )Emerge Energy Services LP (NYSE: EMES) has found support around the $2.22-$2.30 range and looks poised to post a significant bounce from here. It is very oversold and I think the next rally could be a sustainable one for at least the short term. This was a stock that was trading at over $10 a share in January. The high volume on Friday in a RED tape could signal that investors believe the stock is extremely undervalued at current levels or shorts are covering. We could see a 30-50% possible bounce up to $3.25 - $3.5 a share if it can get passed the resistance at $2.52

( click to enlarge )

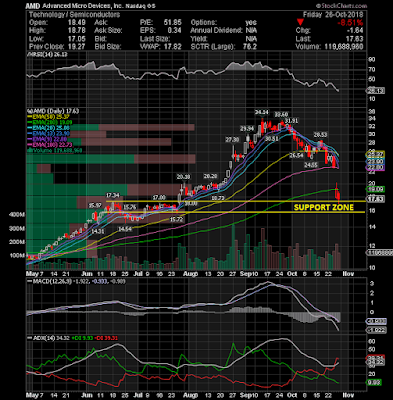

( click to enlarge )Advanced Micro Devices, Inc. (NASDAQ: AMD) is hitting a major support with a very oversold RSI. I think the risk of continued downside at current levels, while obviously present, is a lot less than the possibility of a sharp oversold rally or bounce. I believe there is profit potential from these prices. On watch.

( click to enlarge )

( click to enlarge )InspireMD Inc (NYSEAMERICAN: NSPR) I still think this stock will post a sharp rally from current levels. This was a $1 stock in June and at $.25, in my opinion, and also based on the accumulation line (still rising: under accumulation) there is a compelling risk/reward scenario. Honestly, NSPR is in the midst of that dramatic bounce, one that could see it hit $.48 or more a share in short-term. Note: low-priced "penny stocks" is always risky, so be careful with the size.

( click to enlarge )

( click to enlarge )Pain Therapeutics, Inc. (NASDAQ: PTIE) the chart looks great again for this stock and I think its poised to hit $1.44/1.5 short-term as the selling has abated and the new uptrend should bring new interest into the stock.

( click to enlarge )

( click to enlarge )With a conference scheduled for next week Biocept Inc (NASDAQ: BIOC) is a stock I think deserves some watching over the coming sessions for a potential short-term reversal.

( click to enlarge )

( click to enlarge )ENDRA Life Sciences Inc (NASDAQ: NDRA) The last few days has seen increased volume and price. This is worth watching and possibly stepping in for a trade at some point. This stock has been flying under the radar of many traders and deserves a look going forward.

( click to enlarge )

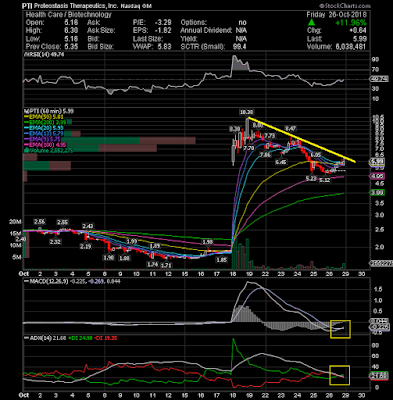

( click to enlarge )Proteostasis Therapeutics Inc (NASDAQ: PTI) Good long setup, if it takes out the 6.3-6.45 zone on volume next week.

( click to enlarge )

( click to enlarge )NII Holdings Inc (NASDAQ: NIHD) appears ready for a breakout above key resistance at 6.44 area. If breakout occurs, I expect to see the NIHD move toward the 7-7.2 area.

( click to enlarge )

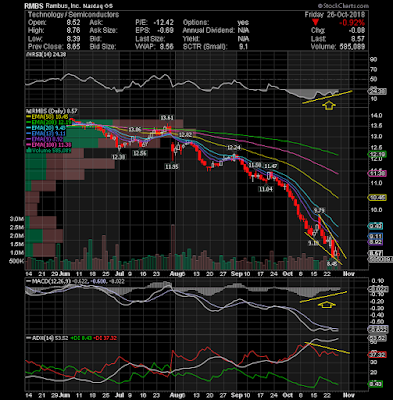

( click to enlarge )Rambus Inc. (NASDAQ: RMBS) looks like a great bottom type play. Technical chart is displaying several positive divergences. I think RMBS will post a nice rally from here and deserves being added to your watchlist.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC