NEW YORK, NY / ACCESSWIRE / March 29, 2016 / Shares of Sports Field Holdings (SFHI) are mispriced after a $5.8 Million purchase order was announced last week and the Company's valuation remained unchanged [1]. Sports Field recently guided for (i) sales growth of 325% in 2016 and (ii) profitability. No one noticed.

Now a $5.8 Million purchase order supports the possibility that the Company could exceed guidance this year.

SFHI shares trade for $1.25, but conservative assumptions show (see Figure 3, below) fair value is at least $2.35, providing investors with potential upside of 88%.

What Happens To Mispriced Shares Underlying A Fast-Growing Company? Inflection.

Mitek Systems (MITK), a provider of identity verification software, is an excellent proxy for Sports Field Holdings' (SFHI) rapid growth and expected profitability. In late 2014, Mitek told its investors that it had doubled the number of financial institutions dependent on its technology and, for the first time, expected to be profitable. As Figure 1 (below) shows, Mitek's shares were mispriced until an inflection point following actual fiscal 2015 results. Shares doubled in price.

Figure 1: MITK Shares Inflect Following Actual 2015 Results

Sports Field Holdings (SFHI) reports full-year 2015 results on Thursday, March 31, 2016. However, emphasis will be on [reiterated] fiscal 2016 guidance, which will lay the foundation for an inflection ahead of further growth foreseeable in 2017.

USA Technologies (USAT), a 'cashless' payment processing company, is another good example of robust sales growth and prudent cost management underlying share price performance. The company guided for continued growth at a 25% clip on the top line and another year of earnings in 2016. Since the start of 2015, USA Technologies has executed on two major partnerships with Apple (AAPL) Pay and Google's (GOOGL) Android Pay, respectively, which are helping drive actual fiscal results. As Figure 2 (below) shows, share price has followed fiscal performance.

Figure 2: USA Technology Shares Up 114% On The Heels of Strong Fiscal Performance

Sports Field Holdings (SFHI) has reported actual fiscal performance, according to an announcement from the Company earlier this month [2].

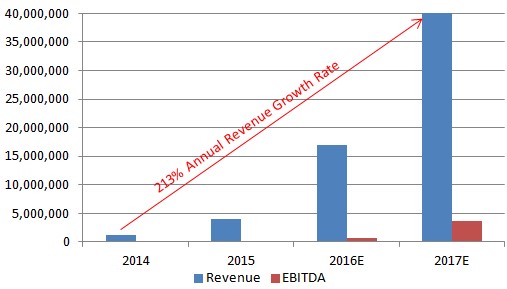

We believe SFHI shares are mispriced because the market has not yet reacted to the Company's execution on its promises to rapidly grow its top-line (Figure 3 shows actual and projected sales and EBITDA).

Figure 3: SHFI Revenues Expected to Grow At Compounded 213% For 3 Years, Creating Mispricing in Share Price

Further, actual projects under contracts already total $10.5 Million, excluding an additional $3.8 Million contract under negotiation, for a total of $14.5 Million. Guidance for fiscal 2016 sales is $17 Million. This suggests that SFHI could beat 2016 guidance and create an even larger disconnect between our computed fair value of $2.35 a share, and recent market price of $1.25 a share. Mitek and USA Technologies (discussed and shown above in Figures 1 and 2, respectively) clearly show upside in owning shares that underlie companies who execute on their guidance.

If Fair Value is $2.35, SFHI Shares Give Investors Potential Upside of 88%

Our thesis is simple: Sport Field Holdings' (SFHI) shares recently traded for $1.25 but are worth at least $2.35. This gives investors potential upside of 88% by owning SFHI.

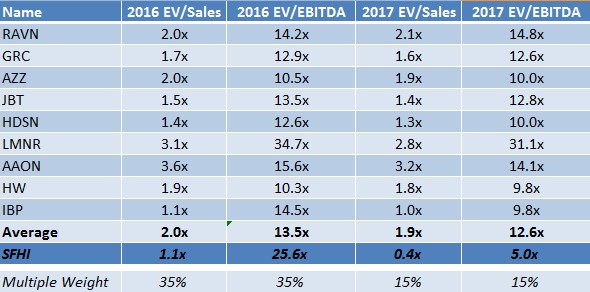

We base our fair value of SFHI on projected 2016 and 2017 earnings before interest, taxes and depreciation/amortization (EBITDA) and enterprise value (EV) to sales. Sports Field is the intellectual property owner of a next-generation turf called "Replicated Grass" that replaces existing sport fields or is used in new construction. To be conservative, we compared SFHI's projected EBITDA to that of construction companies like Head Waters (HW) and Installed Building Product (IBP), whose multiples are smaller than technology companies. Figure 4 (below) shows how SFHI compares in valuation to the most boring constructions companies in the United States.

Figure 4: SHFI v Construction Companies' EV/Sales and EV/EBITDA Multiples.

Pricing Sports Field (SFHI) in line with the multiples that dull construction players are receiving would place fair value at $2.35 per share. We ran with the assumption that SHFI will report an EBITDA on the lower end of the typical 10% to 20% margin that the construction industry averages due to the company's top line growth efforts. For 2016 and 2017, we forecast the company to report EBITDA of $705,000 and $3.63 Million, respectively. We placed the lion's share of our weighting (70% combined) on 2016 projections versus 2017 (30% combined) to demonstrate that even using moderate assumptions, upside in Sports Field is substantial.

The disconnect between SFHI’s fair value of $2.35 and current price of $1.25 clearly suggest a possible inflection and ensuing upside to owning shares. But what is the risk?

SFHI Upside Checked By Risks, Which Management Is Diligently Working to Mitigate

Financing and execution are the two largest risks weighing against potential upside in Sports Field Holdings. However, execution risk - the possibility that guidance is not executed on - is mitigated by already secured contracts for $10.5 Million and an additional contract under negotiation for $3.8 Million, compared to guidance of $17 Million for 2016.

As the Company grows, but before it reaches profitability, it is dependent on outside investment – which is 'financing risk'. Thus far, SFHI has prudently preserved its capital structure, suggesting that while dilution is inevitable, management has existing shareholders' interests at heart when evaluating terms and pricing on new capital. SFHI has also matched dilution with sales growth that is likely to outpace dilution multiple-fold. When we look across the spectrum of companies that have grown their top-line at the expense of their capital structures, we see issuers like Navidea Biopharmaceuticals (NAVB), Cinedigm (CIDM) and Ascent Solar (ASTI), whose shares are down 50%, 90% and 99%, respectively. This is entirely a function of decaying capital structures. For instance, while Cinedigm grew its sales 32%, its shares outstanding jumped 65%. Navidea assumed unsustainable debt that has weighed on its share price. Ascent Solar has grown revenues over 7 fold since 2013, but the company has also seen shares outstanding balloon 216% during the same time.

While SFHI is not yet profitable, management has disclosed specific examples of how it is cutting costs to minimize potential need for additional capital before the Company becomes self-sufficient through its cash flows. It is important to remember that while we used EBITDA as a valuation measure in our model, 2016 and part of 2017 earnings will not be subject to tax, because of the offsetting effect of prior-year carry-forward tax losses, and could approximate cash flow. This suggests that use of EBITDA is a conservative and balanced method for computing SFHI's fair value.

3 Catalysts Drive SFHI Fiscal Performance, Contribute To Potential Share Price Inflection in 2016

- Sports Field is distinguishing itself as the turn-key all-inclusive player that offers the athletic facility construction industry a one stop shop. This full service strategy has been proven popular with investors in Terra Tech (TRTC), a company offering a solution that is proposing to touch every part of the [cannabis] business.

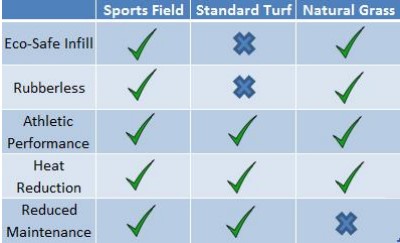

- Water scarcity and the California drought have raised awareness for alternative and environmentally friendly turf products that do not require constant hydration upkeep. Next generation turf offers a solution that is proven to save more than 70% in overall costs [3] and compares with grass fields on minimizing overall athletic injury rates [4].

Figure 5: The benefits driving SHFI’s turf sales

Key Takeaways:

- 88%+ Upside In Owning SFHI After $5.8M Purchase Order Disclosed Last Week

- SFHI has reported ~$14.5M in contracted projects for 2016 compared to guidance of $17M, creating catalyst if guidance is exceeded

- MITK, USAT clearly show how inflection in mispriced names rewards investors; foreshadow potential move in SFHI shares

- SFHI's next-gen turf sales momentum driven by a superior product/service offering and tailwinds from the NFL and EPA's focus on athlete safety on sports fields

- SFHI expected to report full-year 2015 results on Thursday March 31, 2015 and reiterate guidance for profitability in 2016, making this year a potential inflection point for the Company

References

[1] http://finance.yahoo.com/news/sports-field-holdings-inc-awarded-120000476.html

[2] http://finance.yahoo.com/news/sports-field-holdings-fiscal-2015-173719788.html

[3]http://www.wellesleyma.gov/pages/WellesleyMA_SpragueResources/Turf%20vs.%20Natural%20Grass-Cost%20Analysis.pdf

[4] http://link.springer.com/article/10.2165/11535910-000000000-00000/fulltext.html

[5] http://operations.nfl.com/the-game/gameday-behind-the-scenes/nfl-field-certification/

[6] http://a.espncdn.com/nfl/columns/clayton_john/1461243.html

[7] https://www.lawnstarter.com/blog/lawn-care-2/turf-at-nfl-stadiums/

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Sports Field Holdings, Inc. ("Company") as part of research coverage services entered into February 2016. We expect to receive twelve thousand dollars per month and sixty-two thousand five hundred restricted shares of the Company on the 90-day, 180-day, 270-day and 360-day anniversary of our agreement. However, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, One Equity invested into Sports Field Holdings through a 12% convertible note to voice our support and belief in the Company's growth outlook. The terms of the convertible note are fully described in an 8-K filing with the SEC at https://www.sec.gov/Archives/edgar/data/1539551/000121390016011285/f8k021916_sportfieldhold.htm Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/

SOURCE: One Equity Research LLC