- Federal legalization remains elusive

- New York State is another story

- The Feds will act sooner rather than later to open the market

- CURLF- The trend is bullish, and analysts love this company

- The need for revenues is bullish for weed stocks

Nevada legalized marijuana for recreational use on January 1, 2017. The aroma of pot is everywhere in Las Vegas these days. While casinos prohibit weed smoking on the premises, parking lots and streets outside are often thick with the scent. Nevada is one of the growing numbers of states that realize legalization is a revenue source. Moreover, making pot available in regulated dispensaries reduces the nefarious sales channels.

The growth of the pot business in the US has been steady as more states allow recreational and medical consumption. The main roadblock to making the weed business mainstream is federal laws that continue to classify marijuana as a schedule one drug.

The classification creates problems for the pot business as it excludes it from banks and other financing channels. It also makes it a cash business as credit cards cannot be used for purchases. Many burgeoning weed businesses celebrated President Biden’s election in late 2020 as they believed it would pave the way to federal legalization. So far, it has not happened.

One of the leading US marijuana companies is Curaleaf (CURLF). With a market cap of over $10 billion, the Massachusetts-based company trades on the over-the-counter market. CURLF is a pot stock poised for explosive growth or even a takeover when the US federal government finally decides to follow many states.

Federal legalization remains elusive

Democrats have a majority in the House of Representatives and Senate. Most advocate for changes in federal laws that remove pot from its schedule one drug classification. Meanwhile, the top Democrat sitting in the Oval Office is not all that keen on legalizing marijuana. President Joe Biden has been an advocate for decriminalization, but legalization is another story.

In a sign that the President is not ready to join many of his fellow Democrats, the Biden administration asked dozens of White House staff to resign or handed out punishments to those admitting past marijuana use. Representative Earl Blumenauer (D-OR) said, “We still have a very uneven response” to marijuana use in the federal government.

The move to dismiss and punish staff was particularly hypocritical given Vice President Harris’s admission that she had used cannabis in the past. Meanwhile, hopes that the political shift in Washington would cause swift legalization went up in smoke over the past weeks as President Biden appears to remain a roadblock.

New York State is another story

While the federal government balks on the issue, New York State is poised to become the latest jurisdiction to legalize weed for recreational use. State lawmakers reached an agreement to expand the state’s existing medical marijuana program and set up a system to license and tax recreational sales. The legislation sailed through a final vote on March 31.

New York plans to set a 9% tax on cannabis sales, plus an additional 4% tax split between county and local government. The plan includes an additional tax based on the level of THC, ranging from 0.5 cents per milligram to three cents for edible marijuana.

New York will eliminate penalties for possession of fewer than three ounces of cannabis. It will expunge records of people with past convictions for marijuana-related offenses that would no longer be criminalized. Additionally, the state would provide loans, grants, and incubator programs to encourage participation in the burgeoning industry by people from minority communities, as well as small farmers, women, and disabled veterans.

The Feds will act sooner rather than later to open the market

As more states move to decriminalize pot, it will move the needle of support in Washington, DC, towards federal legalization. President Biden can only hold out for so long if his political party’s support becomes overwhelming. The political reality will cause the Feds to move sooner rather than later to open the market and allow banking and financing channels to support the US pot business.

Meanwhile, support for legalization in Congress is growing. On February 1, Senators Cory Booker, Ron Widen, and the Senate Majority leader Chuck Schumer issued a joint statement announcing that marijuana reform bills would be merged as Congress moves towards federal legalization.

The SAFE Banking Act would eliminate interference in the actions of depository institutions dealing with state-legalized cannabis businesses, opening channels for credit card receipts and financing, making pot a mainstream business similar to alcohol and cigarettes. Mexico just legalized commercial cannabis, putting additional pressure on the US government to act.

CURLF- The trend is bullish, and analysts love this company

CURLF is already the world’s leading legal cannabis seller. At around the $15.14 per share level at the end of last week, its market cap was over the $10 billion level. An average of over 1.26 million CURLF shares changes hands each day.

Source: Barchart

Source: Barchart

The chart shows that after falling to a low of $2.54 per share last March, CURLF shares peaked at $18.38 in early February. The stock pulled back and was just above the $15 level as of the end of last week, which many analysts believe is a bargain.

Source: Barchart

Source: Barchart

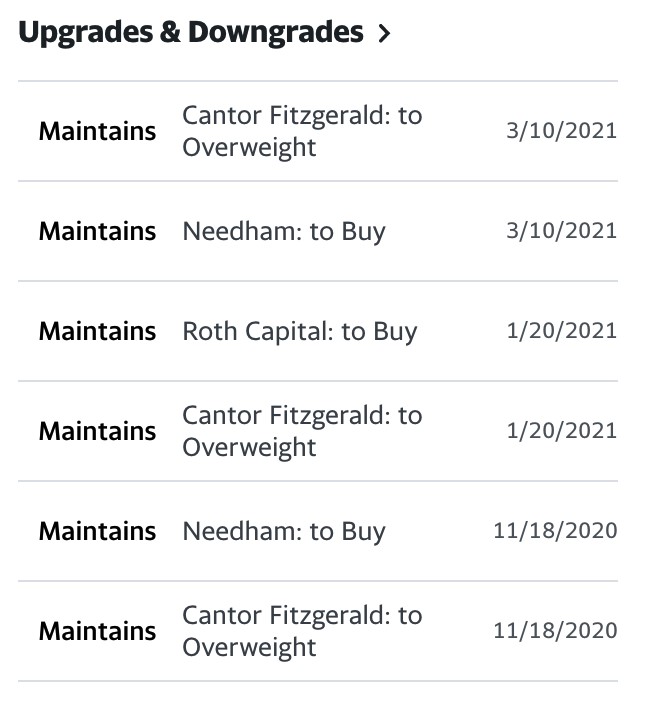

The chart shows that three Wall Street analysts rate CURLF a buy or overweight for portfolios.

The need for revenues is bullish for weed stocks

US states and the federal government need tax receipts. The US debt is heading higher towards the $30 trillion level. The $2+ trillion infrastructure rebuilding package would push it past that milestone.

The need for revenue only increases the odds of federal marijuana legalization. Pot is a growth business. When Washington, DC finally acts, we could see explosive growth and a massive rally in the US companies that are the leaders. CURLF is already the world’s leading legal pot company. We could see the market cap explode to many multiples of the current $10 billion level over the coming months and years.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Unlock the POWR in Your Portfolio!

CURLF shares were trading at $15.50 per share on Monday morning, up $0.36 (+2.37%). Year-to-date, CURLF has gained 29.47%, versus a 8.40% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles.

The post Is Curaleaf Holdings Poised to Move Higher? appeared first on StockNews.com