It’s been one of the most volatile years in history for the US Market, with the S&P-500 plunging at a near-record pace to finish Q1, and now putting together the strongest 50-day rally in history in the back half of Q2. While many bears continue to call for a crash and break of the March lows due to a deteriorating economic outlook, the market seems to have a different plan, as it reclaimed its 50-day and 200-day moving averages in the past two weeks. Thus far, we’ve seen almost zero distribution on the way up off the March lows, suggesting institutions are buying and holding, and not doing any material selling on the way up. This improved technical picture bodes well for several tech stocks, but two names stand out in the space, one with hyper-growth in a niche area, and the other trading at a very reasonable valuation with the majority of investors flocking to the high-growth names. These two names are Five9 Inc (FIVN), and Apple (AAPL), and we’ll below discuss what makes them attractive ideas to buy on the dip below:

While FIVN and AAPL have little in common other than both being technology stocks, both names have generated massive returns for investors, with both names up over 50% last year, doubling the performance of the S&P-500. Also, both companies have stable earnings growth trends, are the leaders in their space, and have been relatively unaffected by the COVID-19 turbulence, as both are sitting at or near all-time highs. The catalyst behind this exceptional share price performance is that they are both expecting to see new all-time highs for annual earnings per share [EPS] in FY-2021 and FY-2022, and growth in the stronger sectors continues to be rewarded in the market. Let’s take a closer look at both companies below:

(Source: Company Video)

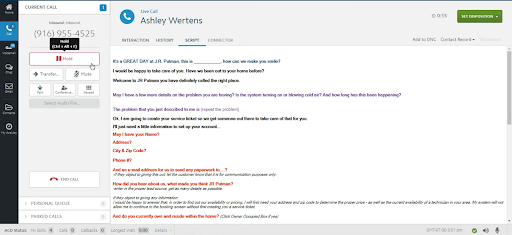

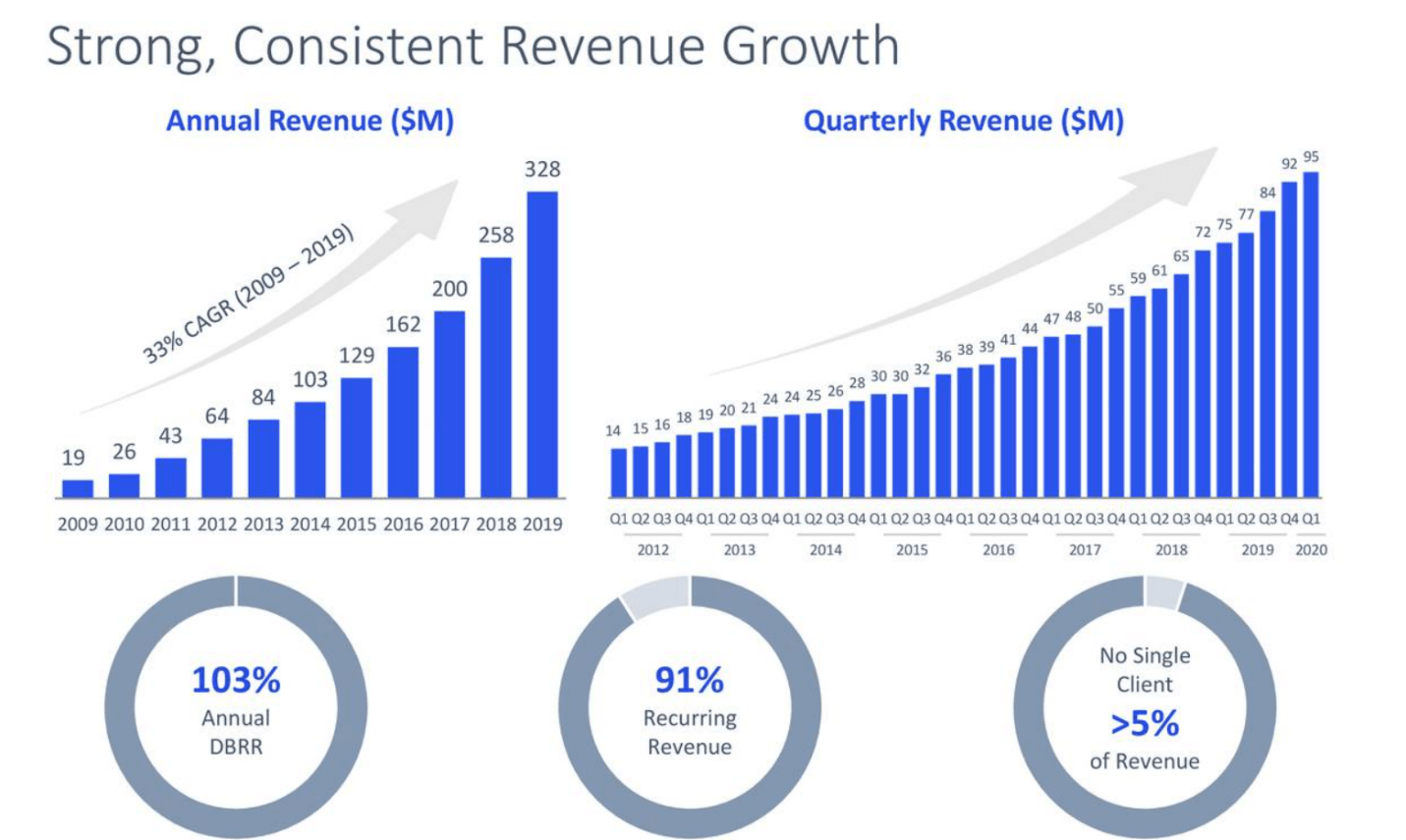

Beginning with Five9, the company is known for developing cloud-based customer contact software that assists contact centers in customer services, sales, and marketing. Five9’s products are catered to businesses in any industry and for any size company, and their products aim to help companies transform from a physical contact center to a cloud-based contact center in as little as 48 hours. While their service has seen massive demand over the past several years as several businesses look to leave their customer service to Five9 or better manage sales and marketing, the recent push towards social distancing has accelerated the trend. This is because physical contact centers do not work in an environment where social distancing is being encouraged. It is clear customers are happy with the service Five9 is providing, as we’ve seen a 33% CAGR in annual revenue since 2009, and net retention rates have remained above 100% each year. Meanwhile, quarterly revenue hit a new record last quarter, at $95 million. Let’s take a look at the company’s earnings trend below:

(Source: Company Presentation)

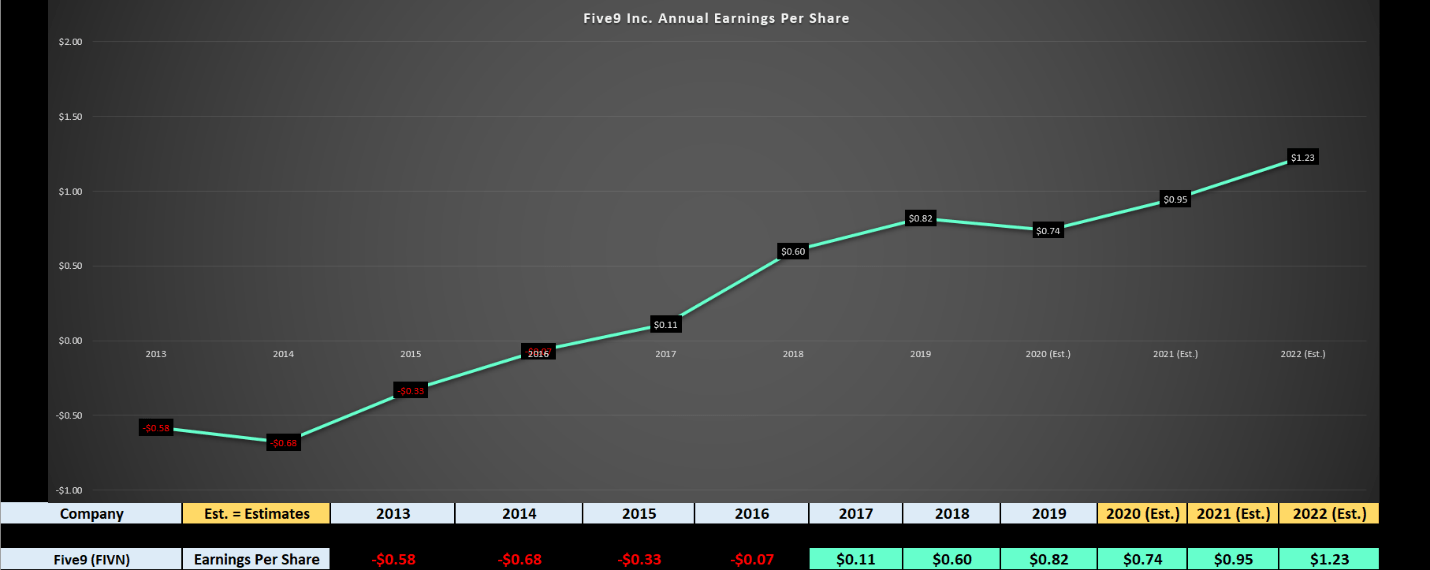

(Source: YCharts.com, Author’s Chart)

As we can see from Five9’s earnings trend, the company saw incredible growth of 36% last year, which lapped a year of over 400% growth, from $0.11 in EPS to $0.60. While FY-2020 earnings are likely to dip a little, with estimates coming in at $0.74, this is not a big deal at all, as FY-2021 and FY-2022 earnings are expected to surge to new highs. Therefore, while Five9 will lag its peers for earnings growth this year with a year-over-year decline, it’s not overly surprising to see this after the incredible growth we’ve seen since FY-2016. Based on FY-2021 and FY-2022 EPS, which is sitting at $0.95 and $1.23, this suggests that Five9 is likely to continue seeing a steady double-digit growth rate, in line with the highest growth names in the Software group. While the company is trading at nearly 100x FY-2021 earnings, this isn’t overly expensive for a company that just grew earnings by over 600% in four years. If we were to see FIVN dip to the $85.00 level, where it would be trading at less than 90x forward earnings, I believe this would present a low-risk buying opportunity for investors

(Source: YCharts.com, Author’s Chart)

Moving over to Apple, the stock needs no introduction, but the earnings trend above is worth highlighting. Apple has seen earnings more than double since FY-2013, despite being a mega-cap company, which highlights the company’s ability to continue innovating in each new cycle and staying relevant despite a sea of competition trying to steal market share. The latest example of this is Apple TV, which could be another driver to the company’s Services business. The most recent case before the push towards TV was AirPods, which have become a household item as many grew tired of untangling cords daily, and were willing to pay up to delete this nuisance from their daily tasks. As we can see from the company’s earnings trends, Apple saw flat earnings in FY-2019, as it reported $11.89 in EPS vs. $11.91, but earnings are expected to accelerate in FY-2021 and FY-2022 based on estimates, with forecasts sitting at $14.81 and $16.45. Assuming Apple hits these estimates, this would translate to a 20% growth year-over-year, an incredible earnings growth rate for a trillion-dollar company.

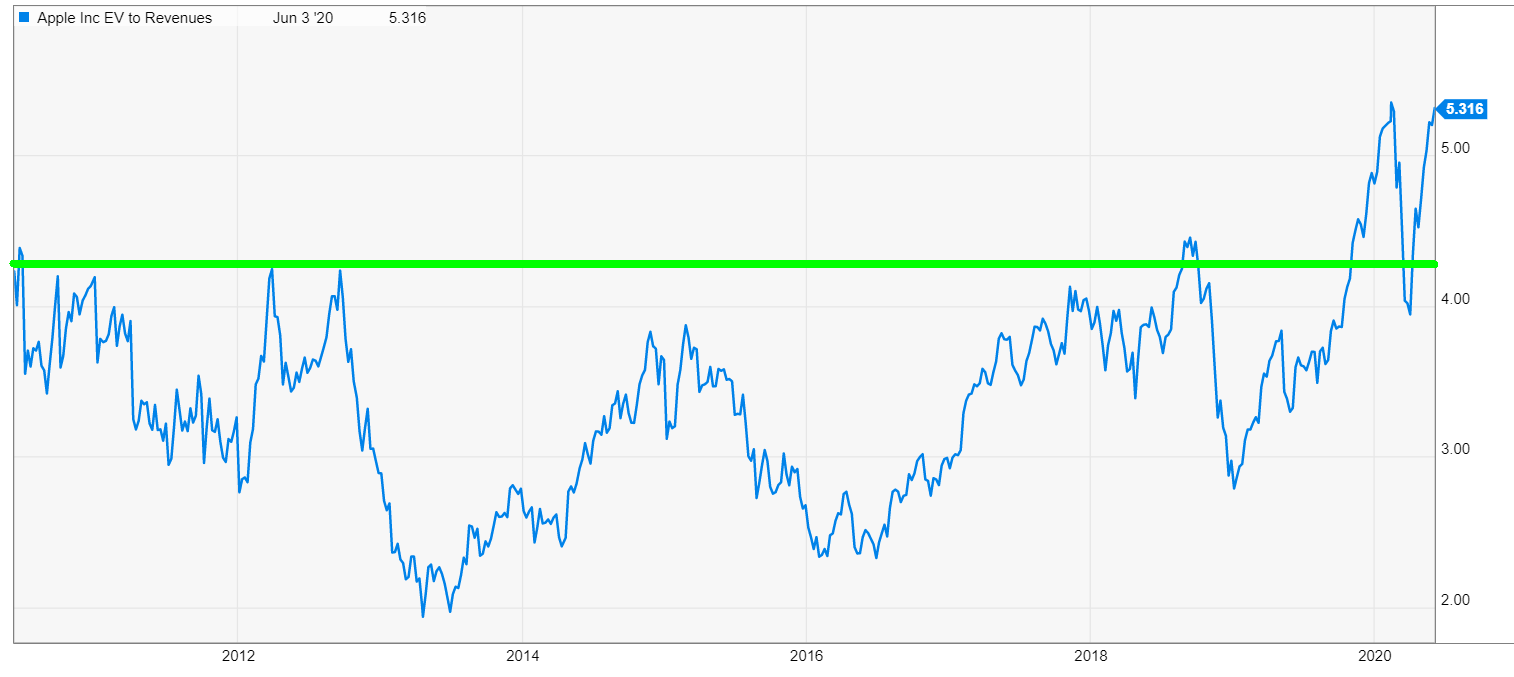

(Source: YCharts.com, Author’s Chart)

While Apple is not cheap here as we've seen a significant rally off of its March lows, it would begin to get very interesting if we could see the stock pullback by 15% or more and head down closer to 4.5x sales. As we can see in the chart above, 4.3x – 4.5x sales used to be resistance for Apple, and it looks like this level has now become new support. This shift is likely due to the company's Services business, which continues to gain traction. Therefore, while I wouldn't chase Apple at $320.00, I believe that any dips to the $285.00 level would provide buying opportunities and a lower-risk entry for the stock.

While many names have seen parabolic rallies since the March lows, and investors are now flocking to the most vulnerable sectors to generate alpha, Airlines, and Cruises, I believe investors should stick to the leaders, but look to buy them on dips. Apple and Five9 are both leaders in their industries and are likely to be much higher in 12 months, but the key is buying the dip on these names, not being tempted to chase them at current levels. I believe the $85.00 level would represent a low-risk area to start a position in FIVN, and the $285.00 level on AAPL would also present a low-risk entry point. While chasing the stocks could work, I believe the noted buy zones bake in more of a margin of safety. For now, I see FIVN as a Hold.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

What If I Am Wrong About the Bear Market? Even stubborn bears need to contemplate why the market continues to rally above 3,000.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

AAPL shares fell $0.19 (-0.06%) in after-hours trading Thursday. Year-to-date, AAPL has gained 10.32%, versus a -2.69% rise in the benchmark S&P 500 index during the same period.

About the Author: Taylor Dart

Taylor has over a decade of investing experience, with a special focus on the precious metals sector. In addition to working with ETFDailyNews, he is a prominent writer on Seeking Alpha. Learn more about Taylor’s background, along with links to his most recent articles.

The post 2 Tech Stocks To Buy On Dips appeared first on StockNews.com