Bitcoin Fourth Epoch, Ethereum 2.0 & Central Bank Blockchain Progress

MAHE, SEYCHELLES / ACCESSWIRE / May 22, 2020 / VYSYN VENTURES is excited to deliver the first release of VYSYN VENTURES Weekly Insights #1 (Subscribe here). VYSYN VENTURES is launching this weekly newsletter to bring greater clarity, analysis, and coverage on developments in the cryptocurrency industry.

Keep up to date with daily curation of crypto developments in the VYSYN VENTURES community Telegram channel.

In the inaugural release, how conditions have changed since the Bitcoin halving, the state of Ethereum 2.0, and the recent blockchain progress made by central banks are all investigated.

Bitcoin Enters Fourth Mining Epoch

A new mining epoch has dawned for the Bitcoin network as the block subsidy declined from 12.5 BTC to 6.25 BTC on the 12th of May.

With far more eyeballs on the Bitcoin network than the first two halvings, this event was preceded by a greater scale of speculation, discussion, and preparation.

With the block subsidy generally representing over 98% of miner revenue over recent years, how miners will be incentivized to keep providing security as the subsidy diminishes has been one of the greatest puzzles facing industry leaders.

The large portion of revenue attributable to the subsidy also means that Bitcoin miner revenue effectively halves after the halving.

Miners raced to upgrade to the most efficient and powerful hardware in the lead-up to the halving as old-gen hardware which was already operating at thin margins was bound to struggle.

The expectation that old-gen hardware would lose their profitability turned out to be accurate.

At the current price and difficulty levels, the breakeven electricity rate for the latest gen Antminer S19 is $0.10 per kWh while the electricity requirement to breakeven with Antminer S9 rigs is $0.025.

Very few miners can access rates as low as $0.025 and even if they did, this is just the breakeven level!

One exception would be Chinese miners in the Sichuan province who can avail of sub-$0.03 per kWh electricity rates during the rainy season (~April to October each year).

Nonetheless, there remains a huge opportunity cost to running S9 rigs if they're taking the potential places of latest generation equipment.

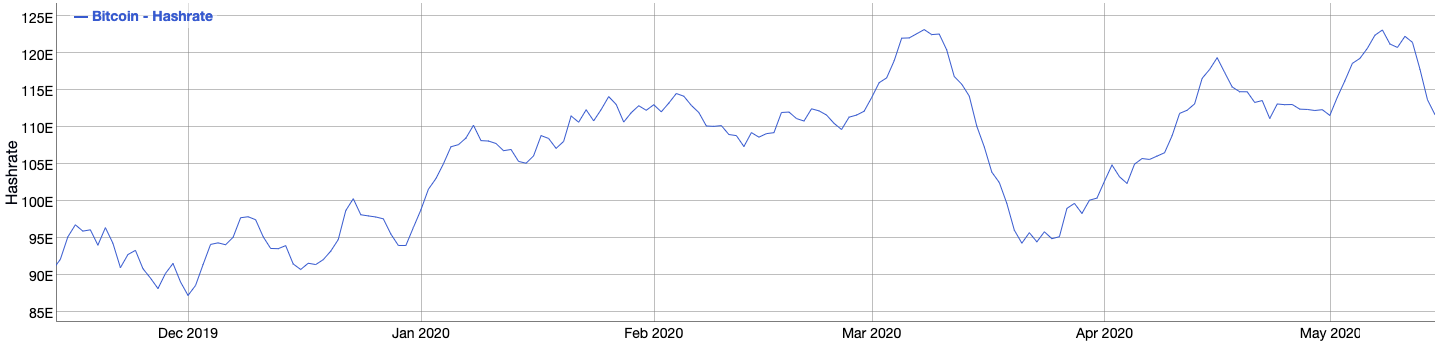

Many miners have expectedly been pushed below their breakeven levels since the halving and the estimated hash rate level has naturally been impacted.

The seven-day moving average of hash rate estimated by Bitinfocharts has dropped from a recent high of 123 EH/s to 111EH/s.

While many analysts were enthusiastic to observe higher transaction fees post-halving, the reduced hash rate makes block times longer which serves to make block space more valuable.

Whether transaction fees as a percentage of total block reward has significantly changed will not be observed until two difficulty adjustments occur.

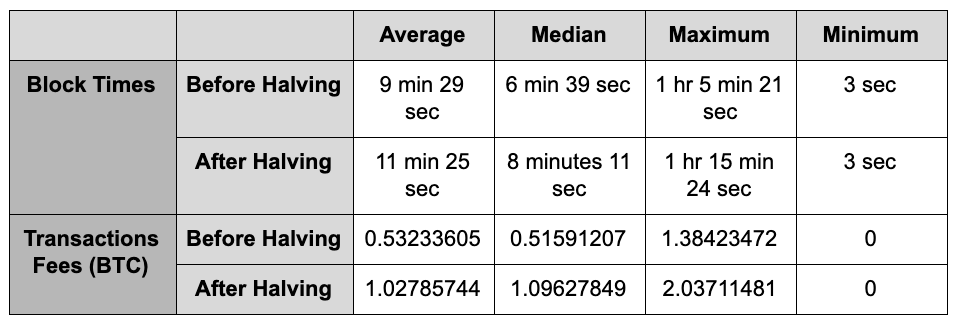

How transaction fees and block times have changed at the current difficulty level before and after the halving can be explored.

The following two segments of blocks were analysed:

- Blocks from 628,993 to 629,999 where the block subsidy is 12.5 BTC

- Blocks from 630,000 to 630,588 where the block subsidy is 6.25 BTC

All of the above blocks were appended at the recent difficulty level of 16.1 trillion.

Here are the results...

Both block times and transaction fees have increased since the halving.

The average and median block time before the halving were 9 minutes 29 seconds and 6 minutes 39 seconds respectively whereas this increased to 11 minutes 25 seconds and 8 minutes 11 seconds after the halving.

Transaction fees effectively doubled with the average transaction per block going from 0.53 BTC before the halving to 1.02 afterwards.

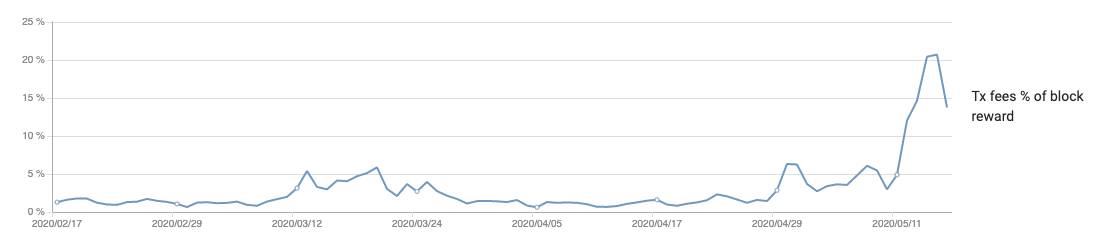

As a result, the percentage which transaction fees represent of the total block reward recently increased to a local high of over 20%.

However, as noted, these factors are interdependent as slower blocks will increase demand for block space.

The second difficulty adjustment after the halving will give a clearer idea of what can be expected in terms of the percentage transaction fees will represent of each block reward.

Ethereum 2.0 Expected in July

Vitalik Buterin recently showed confidence in the progress Ethereum developers are making towards the transition to Ethereum 2.0.

The long-awaited transition is expected in Q3 with many considering the five-year Ethereum launch anniversary on July 30th to be the date when 2.0 launches.

Analysis by BitMEX Research highlights that the launch will just be the first step in what will likely be a "multi year transition to a new network."

The Ethereum network in its current state will initially exist in parallel to Ethereum 2.0 with the intention that both networks merge in the future.

Ethereum 2.0 will use proof-of-stake as the underlying consensus mechanism and will incorporate sharding.

The transition to proof-of-stake and sharding are intended to address scalability issues facing Ethereum.

Upon launch, a one-way peg will be incorporated where tokens can be transferred from the current Ethereum network to Ethereum 2.0 (Eth1 to Eth2) but transferring in the opposite direction is not possible.

Network congestion, growth in smart contract data, and general scalability issues have been identified as headwinds preventing the Ethereum network from fulfilling its vision of becoming the world's computer.

The transition to a network utilizing sharding with proof-of-stake acting as the underlying consensus is an attempt to address such concerns but there is much debate over how effective proof-of-stake will be.

The jury is still out on whether the proof-of-stake can provide the same security assurances as proof-of-work.

Nonetheless, the first phase of what will be a multi-step transition to Ethereum 2.0 is on track to take place in July.

The analysis by BitMEX Research concluded that "Ethereum 2.0 is exceptionally complicated" but "the potential rewards are considerable if it does succeed".

Central Banks Push Forward With Blockchain Technology

Recent months have demonstrated that Chinese authorities are serious about implementing blockchain technology both domestically and on a global scale.

China recently launched its Blockchain Service Network (BSN) with over 100 nodes procuring the infrastructure.

Any entity can apply to run a node but the approval process essentially means that the network will be run by Chinese State entities.

Seven nodes are currently based outside of China in cities including Paris, Sydney, and Singapore.

The motivation behind launching BSN is to lower the costs of deploying blockchain applications and to establish China as a leader in emerging technology.

China has also been pushing forward with innovation on the digital currency front.

The Chinese central bank has been working on a digital currency known as DCEP (digital currency electronic payment).

While there is no official document detailing DCEP, analysis of public statements relating to its implementation suggest that DCEP is intended to replace the Chinese M0 money supply.

The digital currency will be backed 1:1 with the Renminbi deposits and has recently rolled into its test phase where it will be used by workers in Suzhou.

The test phase is expected to last roughly 6-12 months.

---

About VYSYN VENTURES

VYSYN VENTURES LTD. is a leading investment firm which exclusively funds and incubates disruptive digital currency and blockchain projects. The firm specializes in providing go-to-market solutions and advisory services to projects developing innovative solutions at the frontier of the blockchain industry.

---

Media contact

Company Name: VYSYN VENTURES LTD.

Contact Person: KVESTOR

Telephone: +31615580831

E-mail: hello@vysyn.io

Website: www.vysyn.io

SOURCE: VYSYN VENTURES LTD.

View source version on accesswire.com:

https://www.accesswire.com/591064/VYSYN-VENTURES-Released-the-First-Edition-of-Weekly-Insights-for-Subscribers-in-May-2020