Sport boat manufacturer MasterCraft (NASDAQ: MCFT) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 36.3% year on year to $63.37 million. On the other hand, next quarter’s revenue guidance of $75 million was less impressive, coming in 7.2% below analysts’ estimates. Its non-GAAP profit of $0.10 per share was significantly above analysts’ consensus estimates.

Is now the time to buy MasterCraft? Find out by accessing our full research report, it’s free.

MasterCraft (MCFT) Q4 CY2024 Highlights:

- Revenue: $63.37 million vs analyst estimates of $60.71 million (36.3% year-on-year decline, 4.4% beat)

- Adjusted EPS: $0.10 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $3.53 million vs analyst estimates of $1.29 million (5.6% margin, significant beat)

- The company reconfirmed its revenue guidance for the full year of $285 million at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.75 at the midpoint

- EBITDA guidance for the full year is $21.5 million at the midpoint, below analyst estimates of $21.74 million

- Operating Margin: 0.3%, down from 7.1% in the same quarter last year

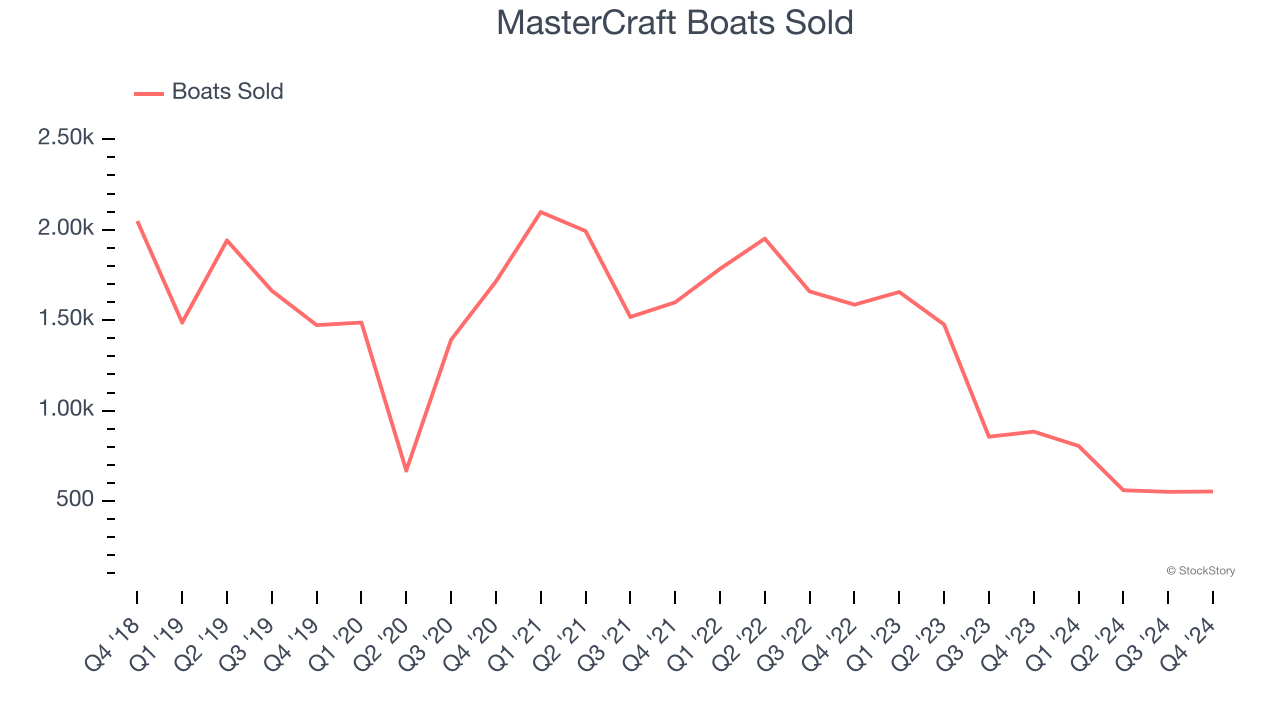

- Boats Sold: 553, down 331 year on year

- Market Capitalization: $306.5 million

Brad Nelson, Chief Executive Officer, commented, “Our business executed well during our fiscal second quarter by delivering results above expectations despite macroeconomic and retail environment headwinds. Early boat show season results have been encouraging, especially with strong demand for our new ultra-premium XStar lineup which has provided positive momentum as we near the summer selling season.”

Company Overview

Started by a waterskiing instructor, MasterCraft (NASDAQ: MCFT) specializes in designing, manufacturing, and selling sport boats.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

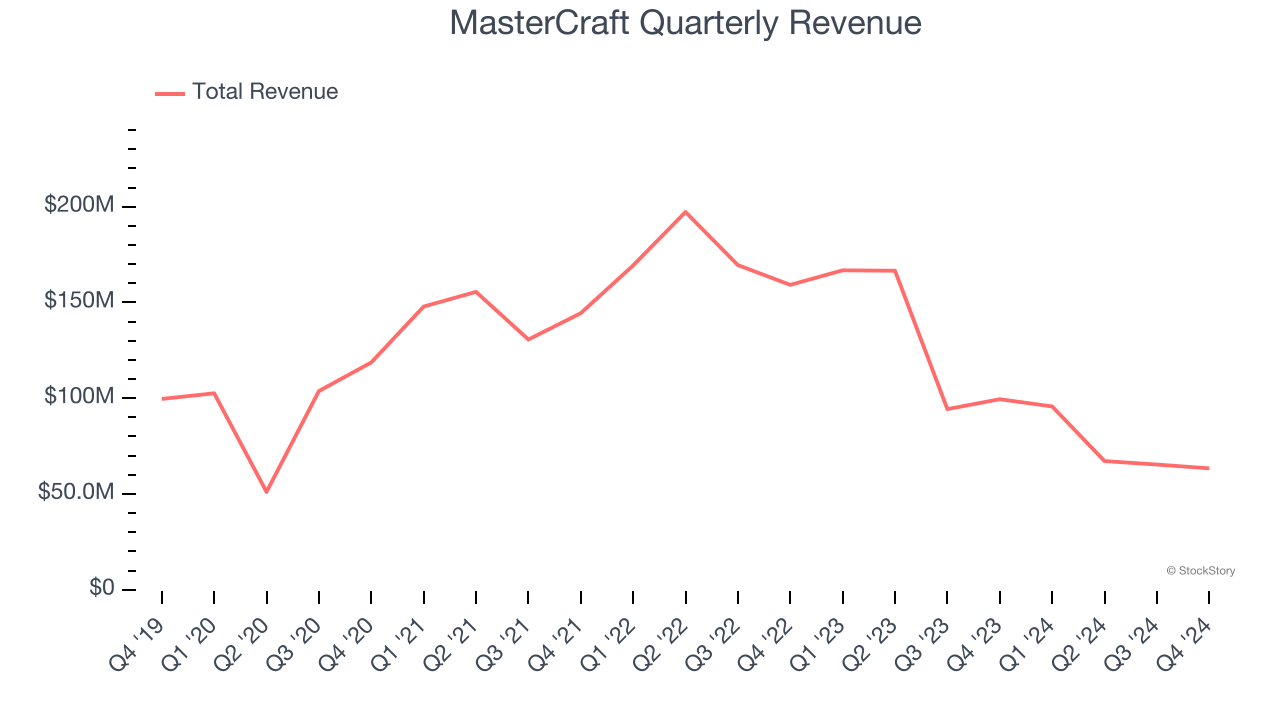

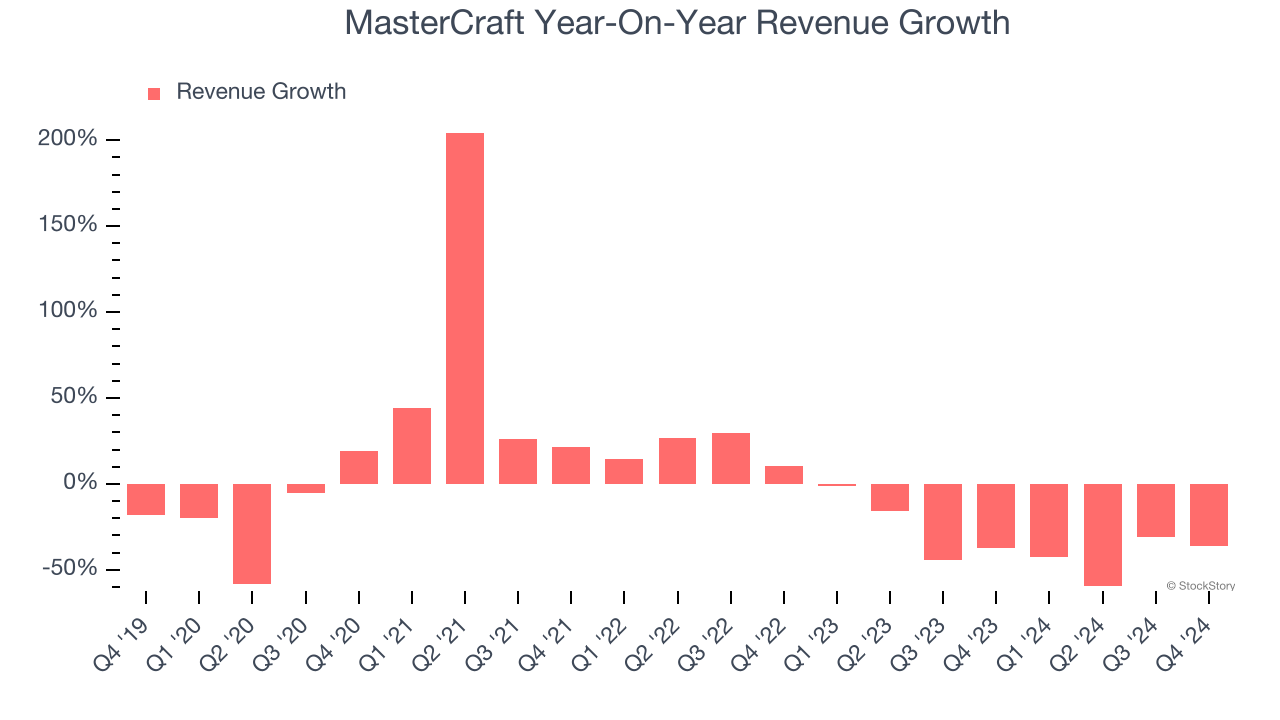

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. MasterCraft struggled to consistently generate demand over the last five years as its sales dropped at a 8.7% annual rate. This was below our standards and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. MasterCraft’s recent history shows its demand has stayed suppressed as its revenue has declined by 35.2% annually over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its number of boats sold, which reached 553 in the latest quarter. Over the last two years, MasterCraft’s boats sold averaged 38.8% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, MasterCraft’s revenue fell by 36.3% year on year to $63.37 million but beat Wall Street’s estimates by 4.4%. Company management is currently guiding for a 21.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.4% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

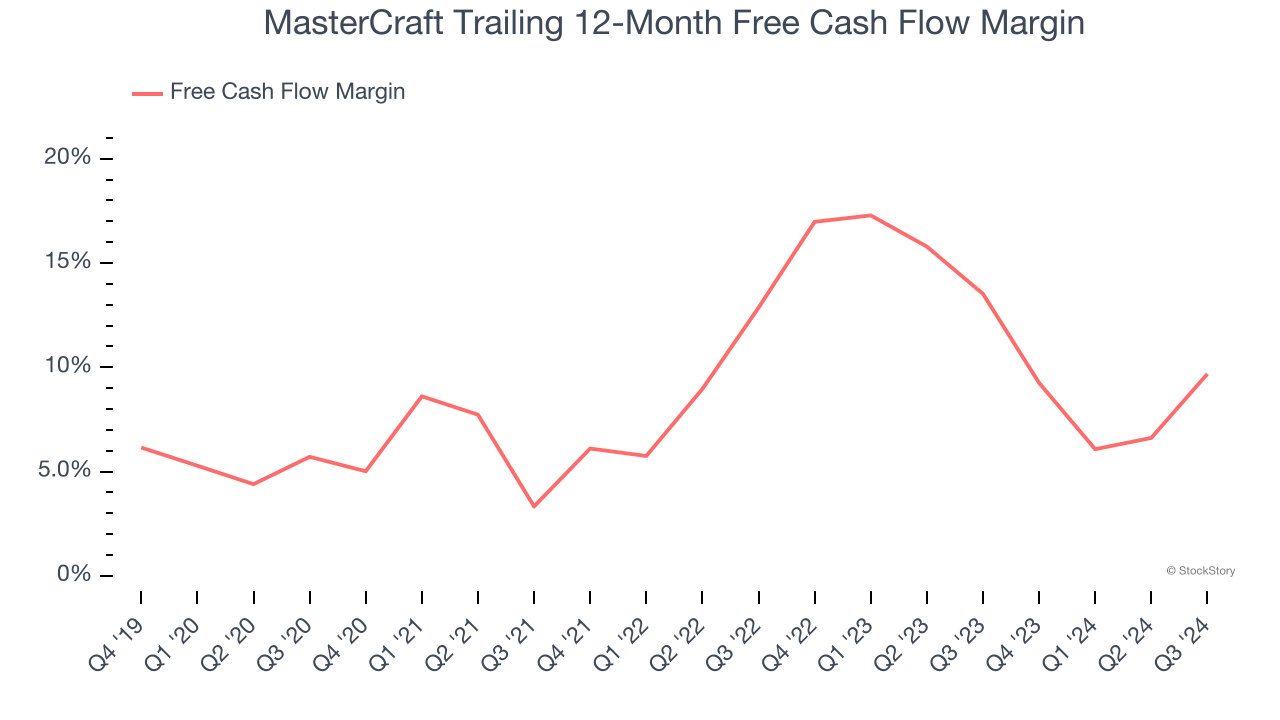

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

MasterCraft has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.6%, subpar for a consumer discretionary business.

Key Takeaways from MasterCraft’s Q4 Results

We were impressed by how significantly MasterCraft blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA guidance for next quarter missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, the quarter was solid, but the outlook was weak. It seems expectations were low, and the stock traded up 5.1% to $19.16 immediately following the results.

So should you invest in MasterCraft right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.